LinkedIn, Retail Investors, and the Lost Narrative

Public companies master two forms of psychological communication long before they go public. They spend billions understanding consumer behavior—how to position products, trigger purchases, build brand loyalty. They invest heavily in institutional investor relations—hiring elite talent, crafting sophisticated investment decks around growth metrics and competitive positioning. Convincing these two audiences generally shapes market sentiment that attracts not just consumers but also retail investors—who now represent a substantial portion of global equity ownership. They drive trading volatility, amplify sentiment, and provide the patient capital that institutions increasingly cannot. Data shows that retail investors can influence company valuations by twenty to thirty percentage points.

Retail investors now account for a meaningful share of trading volumes. Their decisions amplify institutional signals, shape social proof, and can sustain or destabilise confidence long before analyst coverage shifts. These investors are typically driven to invest through one of three routes: a company’s attractive public face (more common in consumer-facing sectors, or a few visible B2B categories with symbolic brands); a market tip (often masquerading as insider insight, though mostly rumour); or self-analysis (usually identifying a favourable data point—a friendly P/E, a strong PAT, and so on). Across all three routes, this aware, educated investor group isn’t just reading balance sheets—they read balance sheets and social media feeds. Yet most public companies still treat LinkedIn and similar platforms as peripheral PR channels instead of what they have become: the frontline of market sentiment.

When public companies ignore this audience, they surrender the narrative of value creation to speculation. A large percentage still communicate only through traditional formats—annual reports, quarterly calls—leaving investors to infer intent. When management fails to articulate trade-offs, priorities, or the rationale behind key decisions, they invite the market to fill in the blanks. Financial reports become cold data divorced from context, forcing investors to perform their own reverse engineering of strategy—and therefore valuation.

That’s where continuous thought leadership becomes indispensable. A company that regularly articulates its logic, long-term bets, and cultural rhythm creates familiarity and trust. Numbers and facts, when wrapped in coherent narratives, feel purposeful. The perception that forms in an investor’s mind shifts from cold analysis to shared understanding.

Rivel Research found that companies with effective investor communication earn roughly a 10% valuation premium, while poor communication can incur up to a 20% discount—a 30-point gap between best and worst practices. For a $10B firm, that difference could mean a $3B market-cap delta.

Yet while many public companies still lack any presence on LinkedIn, those that do are far from leveraging it effectively. Browse the feeds of listed firms and a peculiar phenomenon appears: sophisticated organisations with billion-dollar market capitalisations posting content indistinguishable from recent graduates seeking attention. Generic motivational quotes, obligatory holiday greetings, recycled press releases. LinkedIn has become a box-ticking exercise—an operational task, not a strategic one. In reality, it is the most efficient platform available for building direct relationships with potential investors.

Thought leadership is not social media marketing. When a chief executive publishes an analysis explaining why traditional valuation metrics mislead in their industry—or why conventional wisdom about their business model misses critical dynamics—they are not pitching or advertising. They are educating. The psychological processing shifts from adversarial evaluation to collaborative learning.

This isn’t about “hyping” share prices. It’s about ensuring that investors capable of understanding your business model have the information they need to recognise your value—through clear, consistent, data-substantiated communication, delivered where they actually consume information.

You may also like

Coal, Carbon, and Computers

Climate Cost of the Digital Age

How To Talk To AI

The business leader's guide to AI orchestration

Market Segmentation That Matters

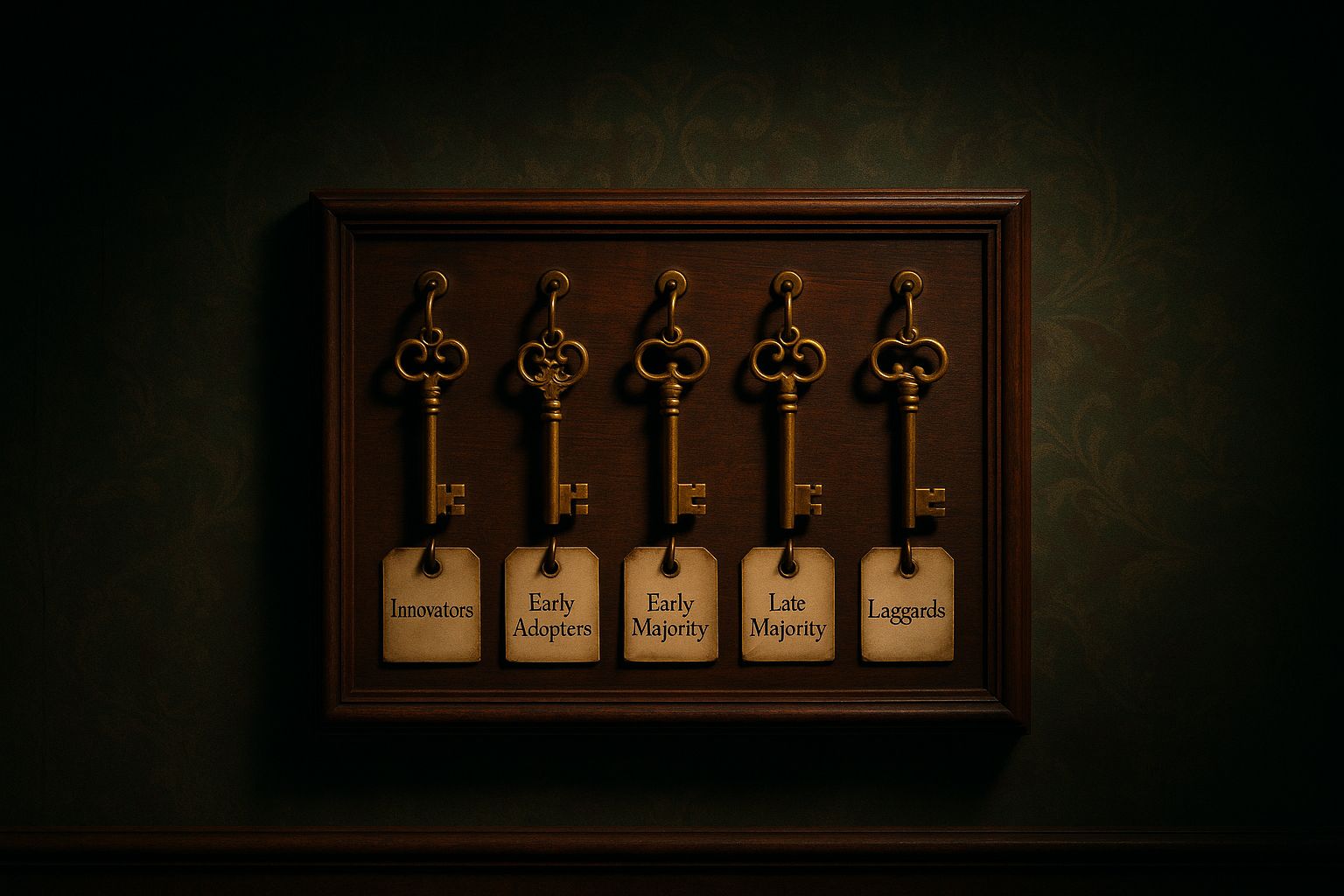

The Innovation Diffusion Curve: How Ideas Go Viral